Interest rates directly impact HMO (Houses in Multiple Occupation) investments by influencing borrowing costs, cash flow, and overall returns. HMO mortgages often come with higher rates and stricter lending criteria compared to single-let properties, making rate changes more impactful for HMO landlords. Here's what you need to know:

- HMO Mortgages Are Costlier: Interest rates for HMOs are higher, with deposits ranging from 20% to 35%. This increases upfront costs and financial exposure.

- Interest-Only Risks: Many landlords use interest-only mortgages to maximise cash flow, but rising rates can sharply increase monthly payments.

- Current Rates: As of October 2025, two-year fixed HMO mortgage rates average 4.5%–5%, while five-year rates are closer to 6%.

- Impact on Returns: Higher rates reduce net yields, as more rental income goes towards repayments. HMOs, however, benefit from multiple income streams, which can offset some of this pressure.

- Regional Variations: Cities with strong rental demand, like Manchester, Edinburgh, and London, often provide better resilience against rate hikes.

Understanding how interest rates affect borrowing, yields, and tenant demand is key for managing HMO investments effectively. Working with a specialist broker can help navigate these challenges and secure competitive mortgage options.

Are HMOs Still Worth It in 2025? | UK Property Investing

How Interest Rates Affect HMO Mortgage Costs

Following the earlier discussion on HMO risks, let’s dive into how changes in interest rates influence mortgage expenses for HMO properties. Since mortgage rates are directly tied to the Bank of England's base rate, even small adjustments can have a noticeable impact on your monthly payments and overall returns. Below, we’ll explore how base rate shifts, the choice between fixed and variable mortgages, and stricter lending criteria shape the financial landscape for HMO investors.

Bank of England Base Rate and HMO Mortgages

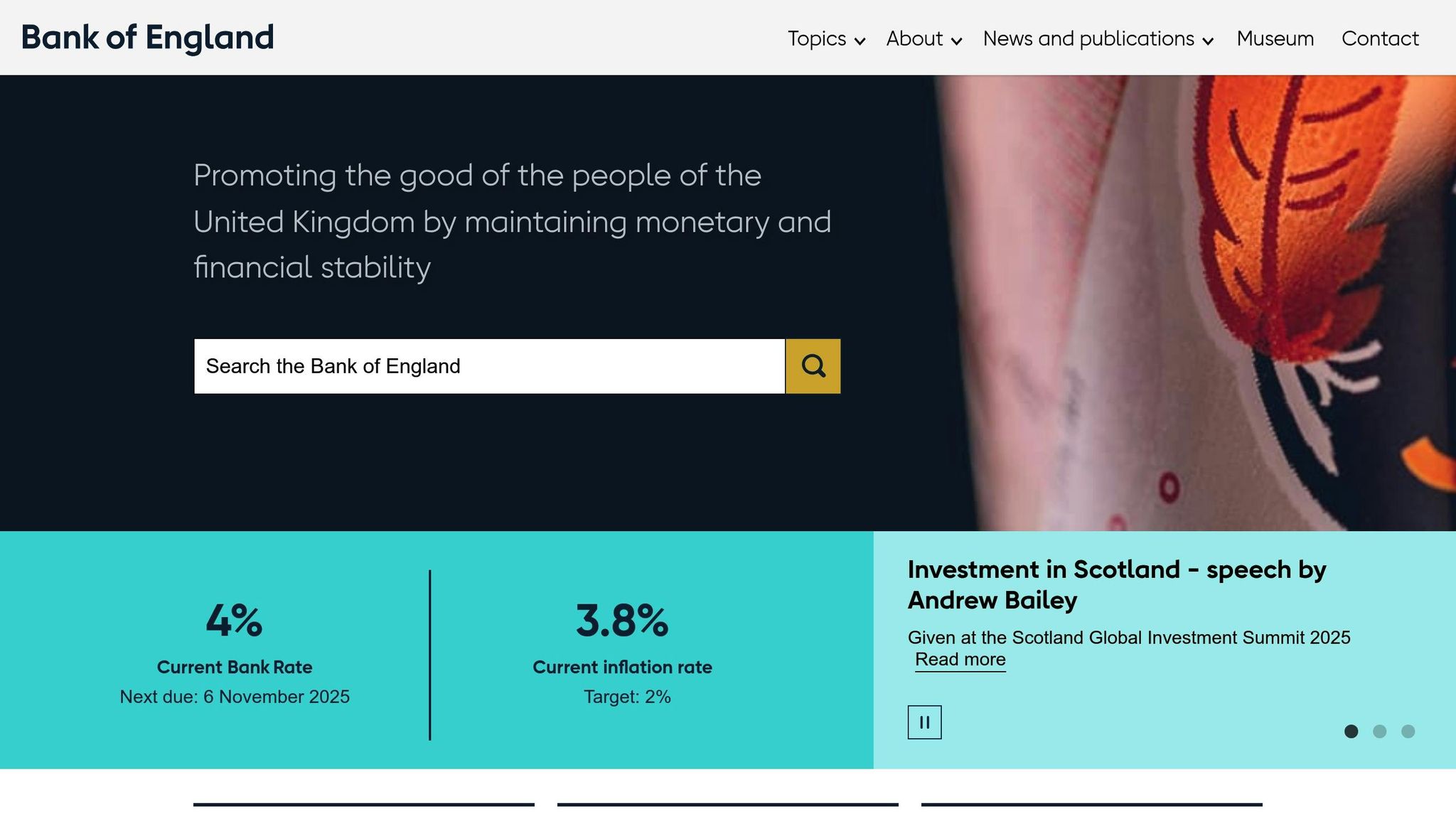

The Bank of England's base rate is the cornerstone of mortgage pricing in the UK. As of October 2025, this rate stands at 4%. The Bank's Monetary Policy Committee reviews this rate roughly eight times a year, considering key economic factors like inflation, growth, and employment levels.

In 2025, the base rate dropped from 4.25% to 4%, reflecting ongoing economic fluctuations. At the same time, inflation remains elevated at 3.8%, far exceeding the Bank's 2% target. This environment of uncertainty underscores the importance of planning ahead when managing HMO mortgage costs.

Fixed-Rate vs Variable HMO Mortgages

When interest rates are in flux, deciding between a fixed or variable mortgage becomes a crucial financial decision. Each type reacts differently to movements in the Bank of England base rate:

- Fixed-rate mortgages lock in a set interest rate for a term of 2 or 5 years, offering predictable payments and simplifying budgeting.

- Variable-rate mortgages, which include tracker, Standard Variable Rate (SVR), and discount mortgages, adjust based on market conditions, leading to immediate changes in monthly payments.

- Tracker mortgages follow the base rate directly, with an added percentage.

- SVR mortgages are determined by individual lenders and generally mirror base rate trends.

- Discount mortgages temporarily reduce the lender’s SVR but increase when rates rise.

Given the appeal of payment stability, fixed-rate mortgages are the preferred choice for many. Currently, 74% of homeowners with mortgages are on fixed-rate deals, and since 2019, 96% of new borrowers have opted for this type of contract. The popularity of five-year fixed rates has grown significantly, jumping from under 30% in 2017 to around 45% by 2021. This trend reflects a widespread desire for financial security during uncertain economic times.

Deposit Requirements and Lending Criteria Changes

Interest rate hikes often lead to stricter lending criteria. Lenders may tighten affordability checks, scrutinising rental income projections more rigorously and applying tougher stress tests to ensure borrowers can manage repayments if rates rise. This means investors face closer financial scrutiny when seeking HMO financing.

Currently, about 850,000 mortgage borrowers have tracker-rate deals, while roughly 1.1 million are on SVR mortgages. These figures highlight how quickly rate changes can ripple through the market, affecting a significant number of borrowers.

For HMO investors, working with experts like The HMO Mortgage Broker (https://thehmomortgagebroker.co.uk) can be a game-changer during periods of rate volatility. Their specialised knowledge helps navigate shifting lending criteria and secure competitive rates, ensuring your investment strategy stays on track.

Impact on Investor Returns and HMO Yields

Changes in interest rates ripple through the world of HMO investments, directly influencing returns and yields. These fluctuations impact monthly cash flow and the long-term profitability of investments. When interest rates rise, mortgage repayments increase, cutting into net yields as more rental income is consumed. On the other hand, falling rates ease repayment costs, improving cash flow and boosting returns.

Net Yields and Cash Flow Effects

Rising mortgage costs can significantly shrink net yields – the actual profit left after expenses. As rates climb, higher repayments put pressure on cash flow, making it harder to cover essential outgoings like maintenance, management fees, and gaps during void periods. This financial strain often forces investors to rethink their expense management or adjust rental prices to stay profitable. Keeping a close eye on how these higher rates eat into returns becomes crucial for maintaining a viable investment.

HMO Yields vs Single-Let Property Yields

The income structure of HMOs stands apart from single-let properties. HMOs often generate higher gross returns because renting out individual rooms can command a premium. However, this comes with a trade-off: HMOs tend to involve higher leverage and more complex financing, which makes them more vulnerable to interest rate hikes. Even small increases in rates can hit HMO net yields harder than those of single-let properties. That said, HMOs have a built-in advantage – the room-by-room rental model creates multiple income streams, which can help cushion the blow of rising mortgage costs.

High vs Low Interest Rate Investment Conditions

Investment strategies need to adapt to the prevailing interest rate environment. Here's how different conditions shape opportunities and challenges:

| High Interest Rate Environment | Low Interest Rate Environment |

|---|---|

| Advantages: Lower property prices, less competition, and steady rental demand as fewer people can afford to buy homes. | Advantages: Reduced mortgage costs, better net yields, and attractive financing options. |

| Challenges: Higher mortgage repayments, tighter cash flow, stricter lending criteria, and reduced net yields. | Challenges: Higher property prices, increased competition, and the risk of future rate hikes. |

| Optimal Strategy: Target high-yield properties, consider shorter-term fixed rates, and maintain strong cash reserves. | Optimal Strategy: Lock in long-term fixed rates, expand your portfolio strategically, and optimise loan-to-value ratios. |

In high-rate environments, savvy HMO investors often focus on properties in areas with robust rental demand, such as student-heavy locations, where occupancy remains consistent. In contrast, low-rate periods encourage investors to take advantage of cheaper borrowing to secure long-term financing and grow their portfolios.

Today’s economic landscape offers a mix of hurdles and opportunities for HMO investors. Seeking expert advice can make a significant difference, helping to refine financing strategies and secure competitive mortgage rates that align with specific investment goals.

sbb-itb-6ef153d

Property Affordability and Market Changes

Interest rate shifts ripple through the property market, influencing both investment decisions and tenant behaviour. These changes often reshape rental trends and regional investment opportunities, highlighting the dynamic nature of the housing market.

Higher Interest Rates and Property Affordability

When interest rates climb, the cost of borrowing rises, significantly affecting property affordability – especially for Houses in Multiple Occupation (HMOs). Higher mortgage rates lead to increased monthly repayments, while stricter lending criteria make securing loans more difficult. During these periods, banks often lower their loan-to-value (LTV) ratios, requiring larger deposits from buyers. This mirrors past lending adjustments, amplifying financial pressures for investors.

The affordability issue doesn’t just impact new purchases. Existing HMO owners can face challenges when remortgaging, particularly if they originally secured their properties with lower-rate mortgages. Refinancing at higher rates can erode profits, leaving some investors stuck with less favourable mortgage terms or even considering selling if returns fall below expectations.

Regional property markets react differently to these changes. Areas with strong economic drivers – such as university towns or major employment hubs – tend to weather rising rates better. In contrast, regions that have seen rapid price growth may experience sharper corrections, sometimes creating opportunities for investors with sufficient capital.

Rental Demand and Occupancy Patterns

Rising interest rates can also drive up demand for HMO accommodation. As mortgages become less affordable, fewer people can purchase homes, pushing more individuals into the rental market. HMOs often appeal to young professionals, students, and key workers looking for cost-effective housing options.

This trend is particularly noticeable in high-cost cities like London, Brighton, and Edinburgh, where HMO rooms offer a way to live in desirable areas at a lower cost compared to private flats.

Economic conditions also influence tenant behaviour. In times of higher interest rates, tenants may stay longer in their current rentals, reducing void periods for HMO operators. Conversely, when rates are low and financial confidence is higher, tenants might move more frequently, increasing turnover for landlords.

Regional factors also play a significant role in shaping the prospects of HMO investments.

Regional Differences in HMO Investment Opportunities

Interest rate changes impact different regions in unique ways, creating varied opportunities for HMO investors across the UK.

In northern cities like Manchester, Liverpool, and Newcastle, relatively affordable property prices combined with strong rental demand from students and young professionals make these areas attractive for investors.

Scotland’s HMO market has shown resilience, with cities like Glasgow and Edinburgh maintaining steady returns despite rising rates. Edinburgh, in particular, benefits from a diverse tenant base that includes students, professionals, and tourists, ensuring consistent demand. Although local regulations can be complex, they help create a stable environment for experienced operators.

The Midlands, including cities like Nottingham, Leicester, and Birmingham, offers a promising mix of reasonable property prices and expanding employment opportunities. These factors support sustained rental demand, even during economic fluctuations.

Coastal towns present a more varied picture. University towns like Brighton and Bournemouth often enjoy steady demand, while areas relying heavily on seasonal tourism can be more volatile during periods of higher rates. Success in these markets depends on understanding local job markets and demographic trends.

London’s HMO market requires careful consideration of factors such as transport links and proximity to major employment hubs. Properties in outer tube zones, which offer good commuting options, often present better long-term prospects than more expensive central areas. London’s diverse economy ensures ongoing rental demand, but balancing high acquisition costs with achievable rental yields is essential.

Navigating these regional differences and aligning financing strategies with current market conditions often requires expert guidance. Specialist advice, such as that offered by The HMO Mortgage Broker, can be a valuable resource for investors looking to make informed decisions.

Working with the Current HMO Mortgage Market

The HMO mortgage market is undergoing noticeable changes as interest rates and regulations continue to shift. Lenders have tightened their criteria, making it more challenging for investors to secure competitive financing. For those building or expanding HMO portfolios, understanding these changes is essential to finding the right solutions.

Changes in HMO Mortgage Product Options

The variety of mortgage products for HMOs has narrowed, with lenders now favouring straightforward cases over more complex scenarios. Loan-to-value (LTV) ratios have decreased, and deposit requirements have increased, meaning investors need to contribute more upfront.

Additionally, lenders have become more selective about the type of properties they are willing to finance. Properties requiring refurbishment or located in areas with strict licensing rules are less appealing to many lenders. Some have even exited the HMO market entirely, while others have implemented stricter stress tests for new applications.

Interest rate options have also diversified, offering both fixed and variable rates. Some fixed-rate products now come with shorter terms, giving investors initial payment stability while leaving room for adjustments down the line. Investors with multiple HMO properties may face further hurdles, as some lenders cap the number of properties they’re willing to finance for a single borrower.

Regulatory Changes Affecting HMO Finance

Regulations around HMO properties are evolving, significantly impacting financing opportunities. Many local councils have introduced Article 4 directions, which remove permitted development rights for HMO conversions. This means planning permission is often required, and lenders are increasingly cautious, frequently asking for confirmed planning approval before offering funds for development.

Proposed legislative changes, such as elements of the Renters' Rights Bill, have added uncertainty to the market. Some lenders have responded by scaling back their HMO lending until there’s more regulatory clarity.

Energy efficiency standards are now a critical factor in lending decisions. Many lenders require HMO properties to meet specific Energy Performance Certificate (EPC) benchmarks. Fire safety regulations have also tightened, with lenders often demanding comprehensive fire risk assessments and evidence of compliance with safety measures. These regulatory demands highlight the importance of staying informed and prepared to meet evolving standards.

Getting Expert Help for HMO Finance

Navigating these challenges can be overwhelming, which is why expert guidance is so valuable. Specialist brokers, such as the HMO Mortgage Broker, provide tailored financial solutions for HMO investments. They offer access to a wide range of products, including fixed, variable, tracker, discount, and offset rate options.

These brokers connect investors with supportive lenders and provide tools like HMO calculators to model financing scenarios. They can also identify opportunities for remortgaging, commercial HMO loans, and multi-unit financing for larger portfolios.

Beyond securing the best mortgage deals, specialist brokers assist with navigating licensing requirements, planning restrictions, and safety regulations. Their expertise ensures that investors can adapt to fluctuating lender criteria and secure financing that aligns with their investment goals. In this complex market, professional advice is an invaluable resource for staying ahead.

Conclusion: Main Points on Interest Rates and HMO Investments

Interest rates touch every corner of HMO investing, influencing everything from mortgage expenses to overall returns. Understanding how these shifts play out in today's unpredictable market is essential for any investor.

When interest rates rise, mortgage payments climb, cash flow tightens, and lenders adjust their criteria – introducing stricter stress tests and higher deposit requirements. This means staying agile is critical, including identifying active lenders who can still meet your needs. While increased rates can put pressure on cash flow, they also open doors for savvy investors who are prepared to act.

It's also vital to keep an eye on the lending landscape. Requirements from lenders are constantly evolving, so knowing what each one expects can make a significant difference in your ability to secure financing.

Regional differences add another layer to HMO investment decisions. Locations with strong rental demand – like university towns or areas favoured by young professionals – often deliver better occupancy rates and consistent rental growth. These factors can help offset some of the financial pressures caused by higher interest rates.

Given the complexities of the market, seeking professional advice is invaluable. Specialist HMO mortgage brokers not only provide access to a wide range of lenders but also help navigate intricate application processes. Their expertise ensures your strategy remains adaptable and aligned with market changes.

As interest rates and regulations continue to shift, staying informed and ready to adjust is non-negotiable. Whether you're stepping into the HMO market for the first time or expanding your portfolio, understanding how interest rates influence your investments is crucial for long-term success.

FAQs

How do changes in interest rates impact the profitability of HMO investments compared to single-let properties?

Interest rate fluctuations tend to have a greater impact on the profitability of HMO (Houses in Multiple Occupation) investments compared to single-let properties. This is largely because HMO mortgages usually come with higher borrowing costs due to their specialised nature. When interest rates rise, mortgage repayments also increase, which can eat into the net yields for HMO landlords. On the flip side, falling interest rates reduce financing costs, potentially boosting returns.

While HMOs often deliver higher rental yields – typically around 7-10%, compared to 4-6% for single-let properties – their higher borrowing costs and leverage make them more sensitive to changes in interest rates. For investors aiming to maximise returns in the HMO market, it’s essential to understand how these factors influence overall profitability.

What can HMO investors do to reduce the impact of rising interest rates?

HMO investors facing rising interest rates have strategies to soften the blow. One option is opting for fixed-rate mortgages, which lock in borrowing costs. This approach offers stability and ensures monthly payments remain predictable, even if rates climb further.

Another key tactic is building a strong cash flow buffer. By carefully balancing rental income against expenses, investors can create a financial safety net to handle unexpected costs or rate fluctuations. Exploring various financing options, including alternative loan structures, can also help spread risk and provide added flexibility.

For personalised guidance and access to competitive mortgage deals, reaching out to a specialist like The HMO Mortgage Broker can make navigating these challenges much easier.

How do regional differences impact the stability of HMO investments when interest rates change?

Regional variations significantly impact how well HMO investments adapt to changes in interest rates across the UK. Take the North East and Yorkshire, for example – these areas often boast rental yields above 15%. Such high returns can act as a buffer, helping investors manage rising mortgage costs more effectively. This makes properties in these regions better equipped to handle fluctuations in rates.

On the other hand, areas like London and the South East tell a different story. With higher property prices and typically lower yields, investments here are more vulnerable to increased borrowing expenses. Factors like local employment rates and housing demand also play a role, as economically stable regions are generally more resilient to interest rate shifts. Understanding these regional dynamics allows investors to make smarter choices about where to direct their HMO investments.